.webp)

.webp)

Fintech Glossary

14 Jun 2024

7 min read

What will you learn?

What is an Exchange Traded Fund

Types of ETFs

How do Exchange Traded Funds (ETFs) Work?

How to Invest in ETFs

If you're new to the ETF world and want to connect some fintech dots, this article is for you! Let's start with the basics.

Exchange-Traded Funds (ETFs) have become an increasingly popular investment vehicle for individual and institutional investors. But what exactly is an ETF?

An ETF, or exchange-traded fund, is an investment fund traded on stock exchanges, much like stocks. Unlike mutual funds, ETFs trade throughout the day at market prices rather than at the net asset value (NAV) calculated at the end of the trading day.

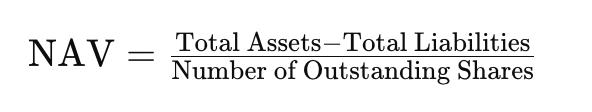

NAV, or Net Asset Value, is the per-share value of a mutual fund or an exchange-traded fund (ETF). It represents the fund's assets minus its liabilities, divided by the number of outstanding shares. Essentially, NAV reflects the intrinsic value of the fund's assets and provides a snapshot of what each fund share is worth at a specific time.

The NAV price is typically calculated at the end of each trading day based on the closing prices of the securities in the fund's portfolio. It is an important metric for investors as it helps them determine the value of their investments in the fund. Here’s a simple formula for calculating NAV:

In the context of ETFs, the NAV can help investors understand whether the ETF is trading at a premium or a discount compared to its actual asset value.

Ok, but this is a definition. What does it mean in simpler words?

ETFs are a good solution for people who are starting to learn about investing. Why? Normally, when you have a certain amount of money and you want to invest it in stock, you need to learn a lot, invest your time, look for specific information, and be up to date with what is happening, not only on the stock market but also, e.g., in geopolitics.

Here comes an ETF (later on, different types of ETFs).

You can buy an ETF that combines stocks of different companies—it's like a package of stocks. That way, you can invest in stocks of, for example, 50 different companies worldwide. It's a safer solution for someone who doesn't have time to follow the stock market and buy and sell stock funds to adapt to changing situations. A person who does that is an active investor. But to be one, you must learn a lot and have time for everyday stock-related decisions.

When you are a beginning investor, you are a passive investor. Your initial strategy is "buy and keep"—you choose what financial instruments you want in your investment portfolio, then buy them and let them grow over time.

But let's go back to our main topic.

What makes ETFs a safer investment option compared to stock funds is that in an ETF, if a particular company experiences a downturn (resulting in a decrease in the value of its stocks), this change will not impact your investment portfolio.

How do Exchange Traded Funds (ETFs) work?

ETFs invest in a diversified portfolio of underlying securities, including stocks, bonds, commodities, or other asset classes. For example, a commodity ETF might track the price of gold, while bond ETFs invest in fixed-income investments such as corporate or government bonds.

There are also currency ETFs that track the performance of foreign exchange rates and industry ETFs that focus on specific sectors, such as technology or healthcare.

ETFs vs. Mutual Funds

Unlike mutual funds, which are priced once at the end of the trading day, ETFs trade throughout the day on stock exchanges. Mutual fund trades are executed at the NAV price calculated at the end of the day, while ETF trading occurs at market prices.

Structure and Tax Efficiency

Most ETFs are designed to be tax-efficient. Their in-kind creation and redemption process can minimize capital gains tax by limiting the need to sell underlying securities.

ETFs and Investment Strategies

ETFs can be used in various investment strategies, including passive investing through index funds and active investing through actively managed ETFs. Both ETFs provide opportunities for diversification within multiple asset classes.

Management of ETFs

The fund manager's decisions can influence an ETF's performance, especially in actively managed ETFs. Management fees for ETFs are generally lower than those for mutual funds, but they can vary depending on the complexity and type of ETF.

Leveraged and Inverse ETFs

Leveraged ETFs aim to deliver multiples of the performance of the underlying index, while inverse ETFs aim to deliver the opposite performance. These ETFs use derivatives and are typically used for short-term trading strategies rather than long-term investments.

Market and Trading

ETFs trade on stock exchanges, making them accessible to individual investors through a brokerage account. ETF trading involves paying attention to factors like trading volume and market price, which can influence liquidity and transaction costs.

Types of ETFs

1. Index ETFs

These track a specific market index, such as the S&P 500 or the Dow Jones Industrial Average.

2. Bond ETFs

Focus on bonds, which can include government, corporate, and municipal bonds.

3. Commodity ETFs

Invest in physical commodities like gold or oil.

4. Leveraged and Inverse ETFs

Are designed to achieve multiples of the performance, or the inverse performance, of the underlying index.

5. Actively Managed ETFs

These do not track a specific index but instead rely on the fund manager's investment strategy to select securities.

6. Synthetic ETFs

Use derivatives like futures contracts to replicate the performance of an index. Synthetic ETFs use derivatives such as swaps to replicate the performance of an index rather than holding the physical securities. They offer exposure to markets that may be difficult or expensive to access directly. However, they carry counterparty risk – the risk that the counterparty to the derivatives contract may default.

Advantages of ETFs

1. Diversification

ETFs expose various asset classes and sectors, helping spread investor's risk.

2. Liquidity

ETFs trade on stock exchanges, allowing investors to buy and sell at market prices throughout the trading day. Liquidity, which refers to how easily ETF shares can be bought or sold without significantly affecting their price, is an essential consideration for ETF investors.

Liquidity is influenced by:

Trading Volume: ETFs with higher average daily trading volumes are generally more liquid.

Underlying Securities: ETFs holding highly liquid underlying securities (e.g., large-cap stocks) tend to be more liquid.

Bid-Ask Spread: Narrower spreads indicate better liquidity.

3. Cost-Effectiveness

Most ETFs have lower management fees compared to mutual funds. This is particularly true for index ETFs, which passively track an index.

4. Tax Efficiency

ETFs are often more tax efficient than mutual funds due to their unique structure that minimizes capital gains distributions.

5. Transparency

ETFs disclose their holdings daily, giving investors clear insight into what they own.

How to Invest in ETFs (briefly)

To invest in ETFs, you need a brokerage account. It's not complicated—most banks have such an option, so you can create a brokerage account in the bank where you have your "standard" account or in a brokerage house.

Once you have an account, you can buy and sell ETF shares just like you would with stocks.

You need to decide which areas interest you in investing in because...

Another important criterion when choosing ETFs is TER (Total Expense Ratio). TER informs us how much we will pay to keep a given ETF in our portfolio. It's worth mentioning that these fees are much smaller than the fees taken by investment funds.

The fee level for ETFs is considered low when it is less than 0.5% per year. However, there are ETFs with fees as low as 0.03% per year. Of course, higher fees do not mean it is not worth investing in a given ETF. It means that it may be more suited to speculative investments and may be more appropriate for more active investors. It all depends on your goals, skills, and level of commitment. To start, ETFs with a low TER will be safer.

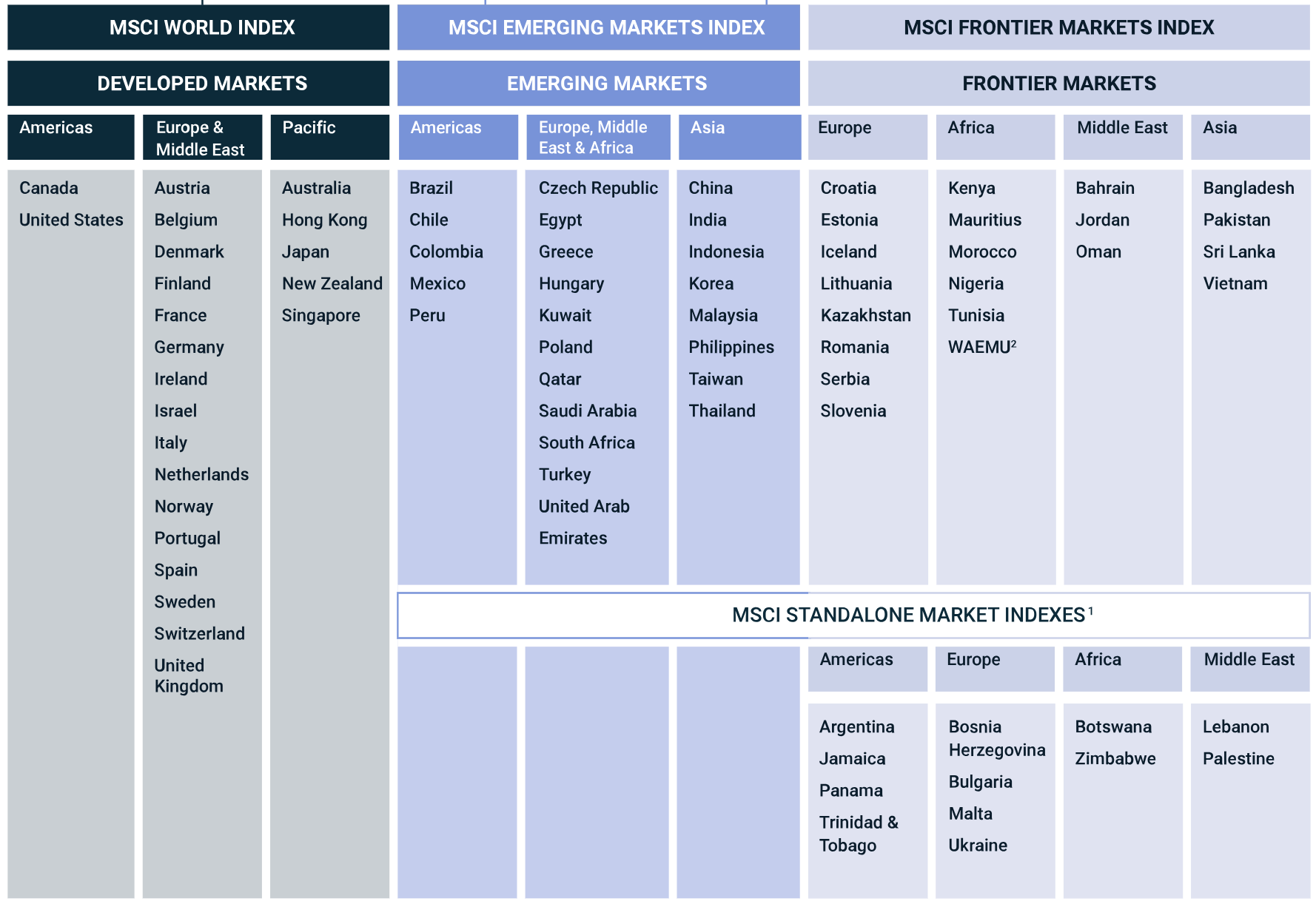

The basic rule for selecting an ETF for your long-term investment portfolio is simple. The less time and opportunity you have to monitor stock market quotes daily, the more general the instrument you should aim for. In this case, you choose an ETF based on global stocks, meaning the shares of companies listed worldwide. The broadest equity ETFs are based on the MSCI All Countries World Index and the FTSE World indices. The MSCI is divided into Developed Markets and Emerging Markets:

Example of Popular ETFs

Some well-known ETFs include Vanguard ETFs, which are known for their low costs (low TER) and wide range of options, and gold ETFs, which invest in physical gold or gold futures contracts. Other popular ETFs might track major market indices or invest in specific sectors or asset classes.

Risks and Considerations

While ETFs offer many benefits, they also come with risks. Market volatility can impact the value of ETFs, particularly those that track volatile sectors or commodities.

Due to their compounding effects, leveraged and inverse ETFs can be risky and generally unsuitable for long-term (passive) investors. Additionally, currency ETFs carry currency risk, especially when investing in foreign markets.

Regulatory Environment

ETFs are subject to regulation by financial authorities, which ensures a degree of transparency and investor protection. In the U.S., for example, ETFs must comply with regulations set forth by the Securities and Exchange Commission (SEC).

ETF Use Cases

ETFs are versatile and can be used in various investment strategies:

Core Holdings: Many investors use broad market ETFs (e.g., those tracking the S&P 500) as core holdings.

Sector and Thematic Investing: ETFs allow targeted exposure to specific sectors (e.g., technology, healthcare) or themes (e.g., clean energy, artificial intelligence).

Hedging: Inverse ETFs can be used to hedge against market downturns.

Income Generation: Bond ETFs and dividend-focused ETFs can provide regular income.

Speculation: Traders often use Leveraged ETFs to speculate on short-term market movements.

Innovations in the ETF Industry

The ETF industry continues to evolve, with innovations including:

Smart Beta ETFs: These ETFs use alternative index construction rules to achieve specific investment outcomes, such as lower volatility or higher dividend yield.

ESG ETFs: Focus on environmental, social, and governance criteria, appealing to socially conscious investors.

Thematic ETFs: Target specific investment themes or trends, such as cybersecurity or genomics.

Performance Comparison

When comparing ETF performance, it’s important to look at:

Total Return: Includes both price appreciation and dividends.

Expense Ratio: Lower expenses can enhance net returns over time.

Tracking Error: Smaller tracking errors indicate more accurate index replication.

Conclusion

ETFs have revolutionized the investment landscape by offering a flexible, cost-effective, diversified way to invest in various asset classes. Whether you're looking to invest in stock markets, bond markets, or commodities, there's likely an ETF that fits your investment strategy.

As with any investment, conducting thorough research or consulting with a financial advisor is crucial to ensure that the chosen ETFs align with your financial goals and risk tolerance.

Understanding the different types of ETFs, their advantages, and their associated risks can help investors make informed decisions and better utilize ETFs in their portfolios.

Understanding these additional aspects of ETFs can help investors make more informed decisions and better utilize ETFs to meet their investment objectives.

Whether a passive investor seeking broad market exposure or an active trader looking to leverage short-term opportunities, ETFs offer a flexible and efficient way to invest in various asset classes and strategies.

#what is a etf, #stock exchange, #traded funds, #exchange traded funds, #exchange traded fund, #fund manager, #incex fund, #currency etf, #exchange traded funds

SERVICES YOU MAY BE INTERESTED IN

Other Posts Related to Fintech Glossary

Learn how we have managed to aid business initiatives around software products

Who Is a Transfer Agent?

The ultimate “middleman” in the world of finances.

Custodian: What does it mean, and who is it?

A custodian is a person or institution whose role is to protect and care for something.

Pros and Cons of ETFs

Imagine someone who wants to invest in the stock market but cannot individually invest in each company's stocks for various reasons—lack of time, knowledge, or resources. This is where ETFs come into play, offering investors a "basket" of diverse assets that can easily be bought and sold, like a single stock.

Asset Classes in Asset Management

An asset class is a group of similar securities that share the same laws and risks and behave similarly.

We know how valuable is your time.

We guarantee that we will not waste it

Let’s talk about your project - we will convince you that we have right people, skills and experience.