Fintech Glossary

29 Jan 2024

5 min read

What will you learn?

What are Transfer Agent's main responsabilities?

What types of Transfer Agents are there?

Example of dividend payments processing

Overview

A Transfer Agent (TA) is the ultimate “middleman” in the world of finances. It operates within the specialized field of transfer agency, which involves managing investor records, processing transactions, and ensuring a smooth change in ownership of company stock.

The transfer agent plays a crucial role as an intermediary, validating and registering new ownership shares and managing the transfer of ownership to ensure accurate and legal transaction processing.

Even though money managers can do everything associated with their funds, like selling shares or supervising payments, it can be a ton of work that quickly becomes unmanageable. That is why there is a place for someone like a Transfer Agent who unburdens money managers with mundane (but still significant) work so they can focus on actual investing, analyzing data, and managing fund prospectuses.

Transfer agents charge appropriate fees for their comprehensive transfer agent services, including managing investor records to maintain records of shareholder accounts, investor relationships, and certificates of security ownership, ensuring compliance with regulations, and providing accurate information to shareholders.

Key Points in Transfer Agent Services

Transfer agents are mostly big organizations like banks or asset management companies, an example being Computershare – one of the biggest and most well-known TAs.

Their main responsibilities include (but are not limited to):

Keeping financial records about investors, their bank account balance, securities ownership, and all the other essential data, and ensuring that records are maintained accurately.

Creating reports for relevant government agencies, such as the Securities and Exchange Commission (SEC) in the United States, and for shareholders, including maintaining the issuer’s security holder records.

Keeping fund’s accounting in order.

Aggregating investor’s requests and taking appropriate actions based on them.

Handling investors’ problems, like ownership verification or certificate issues, including cancelling and reissuing lost or stolen certificates, and cancel certificates to reflect changes in ownership.

Make sure investors receive accurate and timely payments, including distributing dividends to shareholders.

Handling information flow between the company and their shareholders keeps them current.

Calculating net asset value.

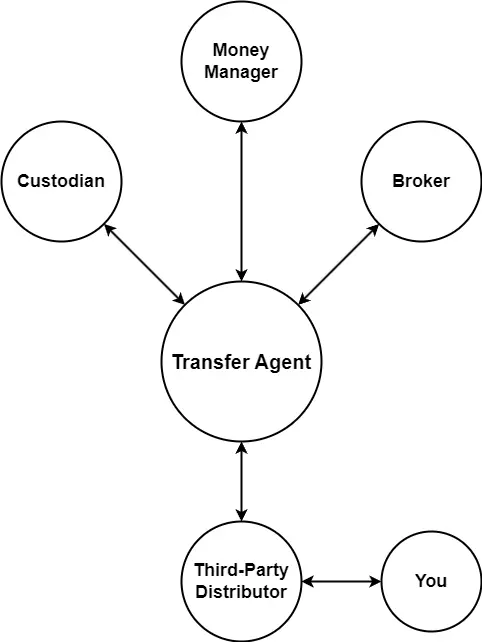

They also communicate and deal with third-party distributors, custodians, and brokers, so you may say they are at the centre of every big fund/institutional investor.

Stock transfer agents play a crucial role in verifying the authenticity of stock ownership through signature guarantees and the issuance of physical certificates upon shareholder request.

Exceptions in Maintaining Issuer's Security Holder Records

The adjective “big” is not used there accidentally. There are small funds (not necessarily small when it comes to their worth, but rather the number of yearly investments or people hired), most often closed-end or private equity funds, that do not use the services of transfer agents.

Those can be, for example, funds for celebrities and their families, where 2-3 people manage the funds with 4-5 transactions a year.

That shows that transfer agents are not required in every scenario but are still extremely useful and have their place in the market.

Types of Stock Transfer Agents

There can be several types of transfer agents, such as stock TA, bond TA or mutual fund TA. Most of their responsibilities are the same, but some differences come with the asset class a specific transfer agent manages.

For example, the stock TA oversees paying dividends to shareholders, and the bond TA must ensure bondholders receive their interest payments.

In the end, both of those examples are about asset transfer, but the details differ.

Example of Dividend Payments Processing

Example

Let us now look at a real-life example. Assume you want to buy some shares in a fund. You would go to your local bank (third-party distributor) and ask them for those shares.

At the end of the day, this bank, acting as a third-party company, would collect all the data about people wanting to buy shares in this fund (and all the other investment funds) and send it to the appropriate transfer agent.

Transfer agents, including those in this example, must be registered with the SEC or a bank regulatory agency.

The transfer agent aggregates data from different third-party distributors and then orders a broker for specific funds based on their prospectuses, performing key transfer agent functions. In the meantime, the TA contacts appointed custodians and send them all the assets for safekeeping.

Fund managers also have insight into all that action 😉, and in some cases, a fund might act as its transfer agent, managing its share registry directly.

SERVICES YOU MAY BE INTERESTED IN

Other Posts Related to Fintech Glossary

Learn how we have managed to aid business initiatives around software products

Custodian: What does it mean, and who is it?

A custodian is a person or institution whose role is to protect and care for something.

Pros and Cons of ETFs

Imagine someone who wants to invest in the stock market but cannot individually invest in each company's stocks for various reasons—lack of time, knowledge, or resources. This is where ETFs come into play, offering investors a "basket" of diverse assets that can easily be bought and sold, like a single stock.

Asset Classes in Asset Management

An asset class is a group of similar securities that share the same laws and risks and behave similarly.

.webp)

What Are ETFs? Everything you need to know as a newbie.

If you're new to ETFs and want to connect some fintech dots, this article is for you! Let's start with the basics.

We know how valuable is your time.

We guarantee that we will not waste it

Let’s talk about your project - we will convince you that we have right people, skills and experience.